the Creative Commons Attribution 4.0 License.

the Creative Commons Attribution 4.0 License.

Driving sustainability transitions through financial tipping points

Nadia Ameli

Hugues Chenet

Max Falkenberg

Sumit Kothari

Jamie Rickman

Francesco Lamperti

Achieving a net-zero-carbon economy requires significant structural changes in the financial system, driving a substantial shift in investment towards low-carbon assets. This transformation of finance is necessary beyond the aim of climate stabilization but is more broadly required to foster sustainably thriving economies. In this paper, we offer a critical discussion of the positive tipping points that can be activated in the financial system to accelerate a fast, sustainable transition. Identifying and leveraging these critical and positive tipping points can amplify sustainable investments and foster transformative changes in the practices of the financial sector. By aligning expectations, steering herding behaviour, mobilizing public finance, reducing capital costs, reaching low-carbon investment thresholds in developing nations, and enforcing robust financial regulations and policies, the financial system can assume a central role in re-orienting economies onto a net-zero and sustainable course. Taken together, such mechanisms highlight the positive tipping points that can be triggered within sustainable finance and emphasize the necessity of policy interventions to activate and capitalize on these dynamics.

- Article

(445 KB) - Full-text XML

- BibTeX

- EndNote

Scientific consensus regarding the need to reduce increasing resource demands is unequivocal (Kreibiehl et al., 2022; Richardson et al., 2023), as humanity faces a confluence of urgent environmental challenges, including climate destabilization and biodiversity collapse. In the face of this unprecedented situation, the financial system is called upon to play its part in shifting the economy back towards a “safe operating space” (Rockström et al., 2009). This necessitates a rapid shift from financing the “undesirable” (i.e. the “dirty”, the “harmful”) to financing the “desirable” (i.e. the “sustainable”, the “green”).

Recent financial regulatory initiatives have advanced climate-aligned objectives by establishing essential frameworks to enhance transparency and accountability in financial markets. Prominent among these initiatives is the European Union's sustainable finance package, which includes a taxonomy of sustainable economic activities, disclosure and reporting requirements (such as the Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR), and additional tools such as standards and labels for benchmarks and green bonds).1 In parallel, the IFRS International Sustainability Standards Board (ISSB) has issued sustainability-related financial reporting standards, addressing investors' growing needs for consistent sustainability reporting (see https://www.ifrs.org/groups/international-sustainability-standards-board/, last access: June 2022).2 Globally, similar initiatives are emerging across both advanced and developing markets (e.g. Japan, Canada, Australia, China, Brazil, Bangladesh, Colombia, Jordan, and Morocco, among others) (see e.g. World Bank, 2024; UNCTAD, 2024). Whether these frameworks are voluntary or mandatory, they share a common rationale: fostering greater transparency across the investment chain regarding corporate actions on climate change and environmental impacts. Enhanced transparency enables financial actors to better understand financial risks associated with environmental factors and to make more informed investment decisions. Ultimately, these initiatives aim to shift financial flows away from carbon-intensive assets and redirect capital to sustainable opportunities to benefit from the enhanced market.

Beyond disclosure frameworks, central banks and financial regulators have implemented targeted instruments to influence sustainable capital flows directly. For instance, the European Central Bank has introduced climate considerations into its monetary policy, prioritizing low-carbon issuers within its corporate bond purchases and limiting the share of assets from high-carbon entities which are eligible to be pledged as collateral. Similarly, the Bank of England has explored adjustments to capital requirements based on climate risks, encouraging financial institutions to minimize carbon-intensive lending portfolios. In China, the People's Bank of China has instituted green lending quotas and credit allocation mandates, channelling finance explicitly toward low-carbon sectors. Collectively, these climate-focused tools encompass a range of prudential and monetary policies, including direct credit allocations and lending quotas, thus contributing to an increasingly comprehensive regulatory strategy that incorporates climate risk-adjusted capital requirements and green refinancing mechanisms (World Bank, 2024). Moreover, supranational institutions such as the IMF and the World Bank have substantially broadened the scope of their operations, positioning climate change as a central priority and incorporating decarbonization policies as criteria for financing eligibility (Gallagher et al., 2024).

Nevertheless, the efficacy of these recent measures in mobilizing capital at the necessary scale remains uncertain (World Bank, 2024). As these approaches are still in their early stages, their impact will require continuous evaluation. Meanwhile, a substantial gap persists in aligning finance with broader sustainability objectives. This gap arises primarily from the financial system's primary function, particularly within advanced market economies, of maximizing financial risk-adjusted returns. Consequently, despite progress in the narratives and available tools, financial markets remain essentially indifferent to the greenhouse gas emissions or biodiversity impacts associated with their activities. The effective implementation of finance in a sustainable manner, or “sustainable finance”, is thus not assured. Indeed, the current economic paradigm to which finance predominantly adheres is based on ever-rising demand, short-term profitability, inadequate environmental policy, and unclear industrial priorities at both national and international levels. In this context, perpetuating historical patterns remains the preferred approach for the financial sector to ensure profitability, and, as such, it fails to fulfil its transformative role (Ameli et al., 2021b; Christophers, 2022). Driven by backward-looking, climate- and nature-blind indicators and ignoring the complexity and systemic impacts of their investments on the environment (Chenet et al., 2021), financial actors continue to allocate massive amounts of capital to environmentally damaging industries, such as fossil fuel assets and deforestation. This practice consolidates carbon lock-ins and contributes to long-term biodiversity decline (FTM, 2023; Ruzzenenti et al., 2023; Svartzman et al., 2021; Kedward et al., 2023a). Ironically, by doing so, the financial sector is driving the accumulation of environment-related financial risks to which, by its own admission, it is now dangerously exposed (Chenet, 2024a).

Our paper discusses a number of mechanisms that may push the financial system towards positive tipping points, potentially triggering transformative change across the real economy by influencing the volume of financial flows and the associated costs. Tipping points describe critical thresholds in a complex system that, if crossed, activate self-perpetuating processes of change that drive the system into a qualitatively different state (Lenton et al., 2022). Here, the complex system under examination is the financial system, broadly defined as the set of banking and non-banking financial institutions, regulatory bodies, and investors, along with the market and non-market relationships they share among themselves and with the real economy. Especially after the Global Financial Crisis (2008–2009), the financial system has been increasingly understood as a complex system (e.g. Farmer and Foley, 2009; Dosi and Roventini, 2019), that is, a system composed of heterogeneous interacting entities characterized by varied emergent properties at the macro level which are shaped by the structure and dynamics of these interactions. The architecture of the financial system determines the direction and allocation of financial flows to different economic actors and sectors, thus propelling activities in favoured segments of the economy with substantial financial capital while constraining activities in less favoured areas. Governments, central banks, and regulatory authorities, through the exercise of their powers to frame policy and regulations, can alter the structure and the dynamics of the financial system. This provides the opportunity to activate positive tipping points leading to a structural transformation of the real economy.

The concept of a tipping point in sustainable finance extends beyond the idea of mere non-linear growth in investment. A true tipping point denotes a fundamental transformation wherein sustainable finance practices become the dominant regime within financial markets, persisting independently of policy support or external inducements. This threshold would represent a state where sustainable investments are no longer contingent on regulatory incentives but are instead sustained by self-reinforcing market dynamics and patterns that make them “naturally” competitive.

We explore several mechanisms – such as expectation alignment, herding behaviour, and technological path dependency – that would collectively enhance sustainable finance as a systemic tool to transform the economy. While initial policies and early market adopters may set momentum, these mechanisms would generate feedback loops that embed sustainability targets directly into investment criteria and asset pricing. By coupling environmental considerations within core financial operations, the financial system would be able to function for the attainment of sustainability targets. Thus, a true tipping point is marked not merely by the scale or growth of sustainable investments but by the structural permanence of sustainability within financial markets once initiated and triggered.

We focus our analysis on positive tipping points, which demonstrate how social, political, economic, or technological systems can shift rapidly into new system states (Tàbara et al., 2018) that reduce environmental harm or address climate challenges. While our examples centre on climate finance, similar principles can be applied to broader sustainability issues, such as biodiversity finance, which is increasingly modelled on climate finance frameworks (Chenet, 2024a). Nevertheless, as highlighted by Kedward et al. (2023b), trade-offs (and synergies) between different sustainability goals are pervasive. A crucial next step will involve moving beyond siloed considerations of these objectives to achieve a comprehensive understanding of the full spectrum of investment impacts.3 Importantly, transformation of the financial system is not a standalone solution but a catalyst within a broader strategy incorporating industrial policy, social equity, and behavioural change. This holistic approach is essential to sustain humanity within planetary boundaries.

Our objective is to leverage theoretical and empirical aspects to examine how the financial system might better address these systemic challenges. Rather than presenting prescriptive solutions, our efforts represent an initial inventory of potential tools. We thus try to provide a broad overview of how tipping points may facilitate the transition to sustainable finance while recognizing the composite nature of the financial system. Some dynamics may hold relevance across diverse contexts globally; others are more suitable for specific sectors, regions, or stakeholder groups.

The next sections are organized as follows. Section 2 discusses the role of the financial system with respect to the problem of sustainability and climate change in particular; Sect. 3 provides a critical overview of the positive tipping points that may be activated in the financial system and offers a (non-exhaustive) review of the available empirical and modelling evidence; finally, Sect. 4 concludes the paper and summarizes the key points.

In the 2000s, the financial sector was largely absent from the key discussions on climate change and the environment. The action of banks on climate change was limited to reporting on the efficiency of their light bulbs and reducing business trips, with no mention of the detrimental consequences of their increasing lending to fossil fuel companies.4 An important milestone was the 2015 Paris Agreement, which explicitly acknowledged the role of finance in addressing climate change through Article 2.1(c) (Zamarioli et al., 2021). Although its full implementation is still pending, it triggered a new institutional regime and narrative related to finance and climate change, highlighting the responsibility of the financial sector to shift the economic pathway in line with climate targets. In the same year, Mark Carney's speech on financial stability and the risks associated with climate change (Carney, 2015) brought the topic of climate-related financial risk to the fore. By emphasizing the urgent need for financial institutions to adopt climate risk management and reporting measures “before it's too late”, Carney initiated an important climate move, mainstreaming climate change in discussions of the financial sector's practices and regulations. Fully establishing transparency across the financial system thereby became a prime goal of financial policy, regulation, and industry efforts in the climate finance arena (Ameli et al., 2021a). A similar path was recently followed by financial institutions and authorities concerning biodiversity (Chenet, 2024a, b). In some respects, Carney's speech can be seen as an institutional tipping point for sustainable finance that kick-started discussions, voluntary initiatives, and, eventually, regulatory mandates that have led to distinct changes in the financial sector's operations and practices.

More recently, the establishment of initiatives such as the private-sector-led Glasgow Financial Alliance for Net Zero (GFANZ) and the Network for Greening the Financial System (NGFS) led by central banks has demonstrated the growing commitment of financial institutions, from commercial entities to public authorities, to align themselves with climate targets. GFANZ signatories committed to reaching net-zero carbon emissions by 2050, in a manner that is in line with the +1.5 °C target (i.e. with limited temperature overshoot and using existing technologies). This marked the first instance in which financial institutions committed and pledged to align with climate targets.5 On the financial authorities side, the NGFS created a landmark governance framework to better coordinate and regulate financial institutions in addressing climate change. Given their status and regulatory strength within the financial system, this has provided a strong signal to financial institutions worldwide that a low-carbon transformation of their activities is imminently needed.

This sequence of events can be viewed as the initial catalyst, or accelerator (cf. Ameli et al., 2023; Fig. 2 p. 33), for challenging traditional practices in the financial system, prompting financial actors to embark on a different path in terms of their investment outlays (Farmer et al., 2019). These initial shifts have the potential to cross critical thresholds (i.e. “tipping points”), where a minor alteration can trigger a larger and systemic change and where non-linear feedback effects act as amplifiers of such change (Lenton et al., 2022). By influencing the allocation of capital to different sectors or activities, the financial system indeed has the power to affect the evolution and composition of the real economy, thereby opening the way to the emergence of tipping points across sectors.

In a variety of historical episodes, the financial system has acted as an amplifier of shocks, both positive and negative. This phenomenon is commonly referred to as the “financial accelerator” (Bernanke et al., 1999; Delli Gatti et al., 2010), which describes how developments in financial markets amplify and propagate the effects of minor changes in the economy. For example, bursts of financial bubbles have triggered uncertainty, instability, contagion among financial actors, and feedback loops that cause ripple effects in the real economy, even though the initial shock was not particularly severe. The Global Financial Crisis of 2008 is a prominent example of such a negative shock. On the other hand, financial accelerators have the potential to amplify positive shocks through, for example, mechanisms which dampen the financial fragility of firms operating in the real economy or enhance the effects of innovation and its diffusion, resulting in positive outcomes in the medium and long run (Lamperti et al., 2021). Similarly, favourable financial conditions can magnify the impact of policies aimed at sustaining aggregate demand, creating significant synergies between prudential, fiscal, and monetary measures.

Finance can also have a more direct impact on the real economy. Following Perez (2003), financial actors and, more prominently, public investors (Mazzucato, 2013) play a central role in enabling technological revolutions by actively contributing to the advancement and implementation of innovative processes, technologies, and services, extending their involvement beyond simply providing funds. In fact, they often take part in the management of the innovation process, assuming the role of financial entrepreneurs and “picking winners”. But other mechanisms can also operate concurrently. For instance, once a particular path is established, financial behaviours can lead to a self-reinforcing cycle where an accepted choice gains momentum and becomes increasingly difficult to change (Arthur, 1989). Also, financial markets have a tendency to replicate the economy as it is and resist making potentially costly new decisions. Finance thus has the capacity to both expedite and impede the dissemination of new products and technologies, particularly those of utmost importance for the transition to a low-carbon future.

3.1 The potential for positive tipping points in sustainable finance

In this section, we outline and critically discuss mechanisms that exhibit the potential to leverage tipping points in the financial system, with a particular focus on those which drive investments towards low-carbon assets and technologies.

Theoretical and empirical evidence suggests that public finance plays a catalytic role in mobilizing investments (Mazzucato, 2013). Indeed, the ability of public actors (e.g. public investment banks, governmental agencies) to take on risk induces private investors to follow. This is not only due to the substantial amount of funding provided by public actors but also because of the quality of financing they offer. Public financing, with its long-term horizons, favourable repayment conditions, and ancillary support, resembles the role of financial entrepreneurs. By underwriting risks associated with low-carbon investments and supporting specific technological trajectories using green subsidies, public finance can mitigate market uncertainty, potentially creating tipping points in the financing of low-carbon projects and assets (Campiglio and Lamperti, 2021; Mazzucato and Semieniuk, 2018). However, the emergence of positive tipping points cannot be easily guaranteed and needs adequate policy support. For example, a mission-oriented industrial policy shaping the behaviour of financial actors under direct or indirect public control (e.g. public investment banks, development banks, government agencies, large public utilities) can increase the likelihood of positive tipping points in the dynamics of investment and hence aggregate production (Dosi et al., 2023).

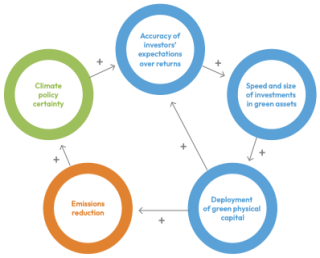

Expectation alignment on the timing and speed of the transition may also act as a tipping point with the potential to significantly scale up sustainable investment (Campiglio and Lamperti, 2021; Campiglio et al., 2024). Uncertainty about the future prospects of low-carbon assets coupled with unclear information about the strength of climate policy may delay substantial portfolio re-balancing decisions. In such cases, investors may adopt a more cautious “wait-and-see” approach, favouring conventional investments whose profitability appears less affected by unclear climate policies. On the contrary, certainty regarding future climate policy schedules through legally binding climate commitments, carbon budgets, and strategic plans can signal the long-term trajectory of the economy, inducing a positive correlation between low-carbon asset returns and macroeconomic performance. This alignment of beliefs can coordinate and shift the strategies of long-term institutional investors (e.g. pension funds), which are typically influenced by a wide range of subjective beliefs about asset returns (Broeders and Jansen, 2021). Hence, aligning expectations on the timing and speed of the low-carbon transition could mitigate risk and spur momentum towards sustainable investments. A shift in the investment behaviour of large financial actors may push the financial system past a tipping point, resulting in a self-reinforcing cycle in which sustainable investments become increasingly attractive, transforming from mere diversification assets into strategic ones (see Fig. 1).

Figure 1A positive feedback loop favouring a tipping point in the dynamics of low-carbon investments. The set of self-reinforcing mechanisms and feedback loops occurring in the process between climate policy certainty and deployment of green physical capital. Expectation alignment creates positive feedback which can be triggered and sustained by certainty in climate policy. The “+” symbol indicates a positive effect (source: Ameli et al., 2023).

Tipping points in financial markets can also emerge through herding behaviour, wherein a critical mass adopts a particular trend, ultimately influencing the broader population to follow suit (Bikhchandani and Sharma, 2000). Herding behaviour refers to the tendency of investors to mimic others, especially during periods of uncertainty or when faced with limited information, resulting in the amplification of market movements. In the context of financial tipping points, herding behaviour can have both positive and negative impacts. On the one hand, it can exacerbate market instability and contribute to the formation of speculative bubbles. When investors flock towards certain assets or sectors, it may lead to an unsustainable surge in prices and valuations. However, on the other hand, herding behaviour can also be channelled positively to drive sustainable investments and foster the transition towards a low-carbon economy. For instance, policy action targeted at the global systemically important banks (G-SIBs) to ensure financial stability by better managing transition risks in their portfolios can induce sector-wide portfolio re-balancing away from fossil fuel investments that are misaligned with climate goals and carry stranded asset risks (International Monetary Fund, 2023). Similarly, critical mass comes into play when a sufficient number of investors adopt sustainable practices (e.g. if GFANZ were to become a dominant approach) or allocate funds to sustainable investments. This creates a self-reinforcing cycle, attracting more capital and generating increased demand for sustainable products and services. Of course, such a self-reinforcing mechanism should by no means give rise to a “green bubble”. The significance of herding and critical mass lies in their potential to facilitate the scaling up of sustainable investments. Herding behaviour can rapidly accelerate the adoption of sustainable investments until a critical mass is reached. Once this tipping point is reached, it becomes easier for sustainable investments to attract more funding and support from a widening pool of investors. This positive feedback loop can lead to a transformative shift in the financial landscape, where sustainability becomes the new norm rather than the exception.

These individual tipping points in financial markets signal the existence of sensitive intervention points (SIPs), i.e. identifiable opportunities for deliberate actions that can trigger associated tipping points. SIPs can either be small “kicks” that trigger positive feedback cycles in a system or can drive a systemic shift in the inherent dynamics of a system that leads to transformative changes even without external triggers (Sharpe and Lenton, 2021; Farmer et al., 2019). Activating an SIP initiates tipping dynamics, causing significant shifts in the market. Policy intervention can serve as the catalyst for such changes directly, by providing the initial “kick”, or indirectly, by shifting the underlying dynamics that bring about the transformation.

Farmer at al. (2019) identified two finance-related SIPs. The first involves financial disclosure and falls into the “kick” type of SIP. Enhanced accounting standards and disclosure guidelines for climate-related financial risks complemented by policy initiatives, such as green taxonomies and sectoral transition plans, could trigger a substantial repricing of fossil assets, such as fossil fuel reserves and securities valuations. This repricing could limit the ability of the fossil fuel sector to invest in new fields, thereby reducing committed emissions. Such a shift would also help to level the playing field for renewables, reduce the risk of stranded assets, and strengthen the credibility of climate targets. This mechanism relies on the theory of market efficiency, where the availability of accurate, climate-related information is essential for optimal investment decisions. With this information, financial institutions are expected to adjust their risk/return expectations, leading to reallocation of capital without needing an explicit intention to support climate goals.

However, while climate risk disclosure has become a prominent tool among financial authorities over the past decade, its effectiveness has inherent limitations (Ameli et al., 2020, 2021b). Specifically, markets may struggle to fully incorporate climate risks into asset prices, given the long-term uncertainties and evolving nature of the low-carbon transition. Increasingly “interventionist” regulatory measures, particularly in Europe, aim to address these limits by providing additional long-term guidance and structuring incentives to reinforce the impact of disclosures on financial markets.

The second SIP pertains to technology selection and a targeted “shift” towards low-carbon investment. Contrary to traditional portfolio theory, diversification of investments can be detrimental, especially when it comes to developing novel and uncertain technologies where spreading resources too thin can hinder significant progress. Instead, rapid progress requires concentrating resources on specific technologies (Way et al., 2019). For example, solar PV has achieved remarkable progress due to targeted support, becoming cheaper than most alternatives. The next step is to similarly focus on developing technologies that can accelerate the deployment of solar PV, such as energy storage. In essence, inducing a tipping point in this context involves not attempting to invest across a broad range of options with hopes of developing each of them but concentrating efforts on technological complementarities that synergistically support research, development, and actual deployment. Furthermore, identifying these technological complementarities dramatically reduces technological uncertainty, which would amplify the dynamics of technology diffusion even further. In contrast to pure market mechanisms, such choices may be directly or indirectly fostered by public sector interventions, in line with some sustainability transition planning. The objective here is to align financial portfolios with an environmental goal or scenario.

There may, however, be trade-offs involved between the two SIPs wherein the policies and practices related to disclosure of climate-related financial risks and portfolio realignment may result in lower investments in low-carbon projects due to a higher perception of transition risks. This is possible both in cases of “bridge” technologies that may have uncertain prospects in the longer term, such as hydrogen-fuelled transport or storage solutions, and innovative low-carbon technologies, such as marine power, whose future cost and deployment trends are highly uncertain. The inherent uncertainty of the energy transition may create a perception of higher risks due to indeterminate eventual outcomes, specific technological trajectories, or timing of different climate-mitigating actions. Strong policy choices, however, can foster market confidence, despite risks of inefficiency, to create a conducive environment where portfolio realignment is accompanied by higher investment in technologies necessary for a timely energy transition.

3.2 Empirical and modelling evidence of tipping points in sustainable finance

In terms of empirical and modelling evidence, a variety of examples show how the financial system can play a pivotal role in activating tipping points to accelerate the transition to a net-zero carbon economy.

In developing countries, policy support can help to overcome climate investment traps created by the high costs of accessing finance (Ameli et al., 2021a). Access to finance, understood as the costs of raising funding for a specific project from different sources, varies significantly across countries. For instance, in some African nations, such as the Democratic Republic of the Congo, Madagascar, and Zimbabwe, the cost of capital can soar to 30 %, while, in developed countries such as Germany and Japan, it can be as low as 3 % (Ameli et al., 2021a). The high cost of accessing capital is preventing developing countries from decarbonizing their economies. Levelling the finance playing field could thus help poorer nations to steer their economies onto a net-zero course.

While energy system transitions in developing economies require particularly high investment, these parts of the world are also particularly financially constrained. They are characterized domestically by underdeveloped capital markets and a lack of capital stock (Ameli et al., 2021a). Furthermore, international finance is restricted due to high sovereign and local currency risks. Projects funded with foreign currency while generating returns in local currencies lead to volatile economic fundamentals (Ameli et al., 2021b; Bilir et al., 2019), resulting in restricted access to external funding sources. This leads to a chronic lack of available finance to support low-carbon investments, creating a climate investment trap which occurs when climate-related investments remain chronically insufficient, with dynamics similar to those of the poverty trap (Ameli et al., 2021a). A self-reinforcing cycle takes place where high risk perceptions lead to increased capital costs, delaying the transition to cleaner energy systems and carbon emission reductions. Climate change impacts exacerbate the situation (Kreibiehl et al., 2022), causing adverse impacts on production systems, economic output, unemployment, and political stability (see Fig. 2).

Policies that reduce capital costs, such as credit guarantee schemes, foreign exchange hedges, and political risk insurance, can shift risk away from private investors, resulting in a lower cost of capital that may act as a tipping point for low-carbon technology deployment and allow developing economies to achieve large sustainable energy capacity and faster emissions reduction. In the case of Africa, reducing the cost of capital by 2050 would allow the continent to reach net-zero emissions approximately 10 years earlier than when reduction is not considered (Ameli et al., 2021a).

Figure 2A climate investment trap. The figure shows the set of self-reinforcing mechanisms and related links occurring in developing economies characterized by high cost of capital. The strength of these links is strongly linked to local conditions, implying that the set of self-reinforcing mechanisms could be exacerbated (or less relevant) in some economies. Note that some mechanisms are more relevant at global/regional levels through aggregations across developing countries. For instance, local greenhouse gas emissions are not necessarily linked with local climate impacts.

Additionally, the flow of international capital into renewable projects in developing countries is influenced by path dependency, creating a tipping point in the scaling up of renewable investments (Rickman et al., 2023). Countries with a track record of renewable investments are more likely to attract future investments, leading to positive feedback loops within renewable energy markets. As countries build a track record in renewables, market confidence grows, bringing down financing costs and attracting further investments in a virtuous cycle (Egli et al., 2018). Climate investment thus evolves through the strengthening of historical investment and capital stock, rather than new investment. However, this also results in an “investment lock-in” across countries and income groups, with only a small fraction of countries receiving the majority of investment. Between 2010 and 2019, 76 % of private capital and 67 % of public funds went to the top eight recipient countries (Rickman et al., 2023).

Evidence of path dependency thus implies a new mechanism of the “climate investment trap” whereby historical inequities in financing are locked in across countries and income groups and perpetuate over time. To escape this investment lock-in, developing countries must mobilize sustained investment to build a renewables track record that creates market confidence and attracts private finance. Indeed, there is a non-linear relationship between the probability of private investment in developing countries and their track record in renewables investment, as measured by installed capacity. Once a significant capacity base of around 1 GW (of wind or solar) is installed, a tipping point is reached and the probability of private investment increases sharply (Rickman et al., 2023). Crucially, low-income countries (e.g. in sub-Saharan Africa) fall far below this threshold, highlighting the inefficiency of opening finance channels into poorer nations without sustained investment which can mobilize private finance at scale. Investment decisions by public actors should thus move beyond project-specific inducements to support more holistic renewable roadmaps and unlock developmental co-benefits (Schwerhoff and Sy, 2017). Innovative financial and policy mechanisms, such as transition plans with public funding from multilateral agencies and associated labelled transition financing products, can target the evolution of the sector and build networks of relationships in the financial sector to initiate path-dependent flows from private sources (Ameli et al., 2021b) and leverage tipping points in the renewable finance ecosystem.

Inducement effects between investors are another example of tipping points that can be leveraged in sustainable finance. Financing in renewables markets is driven by a heterogeneous set of actors spanning the energy, financial, utilities, and diversified sectors (Mazzucato and Semieniuk, 2018), who invest according to their investment remits, preferences, and capacities, as well as technological maturity and the market environment. They collaborate across the development and operational stages of a project based on their risk appetite and expected return, contributing different types of capital to the project in the form of equity and loan investments. Their interaction and relationships drive the market growth and technological maturity of renewable technologies within the energy system, resulting in unique emergent characteristics of the renewables sector across countries based on their enabling investment environments.

In solar finance markets, co-investment relationships between different actors are established at different stages of the market's development and evolve with the continued growth of the sector (Kothari et al., 2025). Actors exercise influence over their peers by inducing them into the market and leveraging their investments alongside their own. Facets of these relationships differ between different actors in the solar sector based on existing co-investments, the market position of actors, and the alignment of their interests. As markets evolve and different actors enter the market, these processes of influence create tipping points in investment trajectories. In the initial stages of the market development, for instance, investments by government agencies induce investment by international institutions, supporting the initial deployment of the technology. Increasing investments by renewable energy companies similarly influences the actions of state-owned and private utilities. As markets grow, the involvement of institutional investors creates the largest leverage (i.e. the amount of investment attracted) through sizable investments from the private banking sector, their natural debt partner in renewable projects. The development of this relationship thus creates large flows of investment into solar energy as a result of its investment dynamics.

Country context also determines the structure of solar finance markets and the strength of relationships between different actors. The influencing power of different actors differs significantly across countries. For example, in the United States, private bank lending induces investments from a range of energy and diversified sectors, whereas, in China, government agencies and state-owned banks are major influencers, and, in Germany, renewable energy companies and state-owned utilities exert a strong influence (Kothari et al., 2025). From a policy standpoint, it is therefore important to consider the impact of policy instruments on prominent actors in solar financing and the relationships that are driving the markets. Creating incentives for these actors or effectively using the relationships formed by government agencies and state-owned actors can induce other actors into the markets and trigger non-linear growth of investment, particularly from the private sector.

Theoretical modelling also reveals tipping points in the global network of banks which supply debt to the fossil fuel industry (Rickman et al., 2024). A sharp decline in fossil fuel use is necessary to achieve the Paris Agreement target of keeping global temperature rise below 1.5 °C (Tong et al., 2019), and this will require a corresponding decline in bank lending to the fossil fuel sector (Kirsch et al., 2021). However, mainstream financial theory holds that debt flows to the fossil fuel sector will be resilient to the phase-out of lending by climate-friendly banks, as their capital can simply be substituted by banks with a neutral stance on the climate transition (Ansar et al., 2013). Capital substitution thus poses a challenge to a system-wide decline in fossil fuel lending in an unregulated market.

Macroprudential tools,6 such as capital requirement rules, offer a potential solution by restricting the value of fossil fuel assets that a bank can hold based on their capital reserves. Models suggest that, while fossil fuel debt markets are resilient to the unregulated phase-out of capital, the introduction of carbon-tilted macroprudential regulation can trigger a rapid contraction of fossil fuel debt flows. The first banks to exit the fossil fuel debt market have little impact on debt flows, as their capital is substituted by other banks. However, a sudden transition is observed after a certain number of banks have exited the sector, at which point debt flows sharply contract. The tipping point depends critically on the stringency of regulations: the number of banks that must exit the sector before the tipping point is reached decreases rapidly as regulatory rules are tightened. Moreover, the tipping point is reached sooner if large banks (G-SIBs) move first and coordinate their actions.

The implementation of carefully designed macroprudential regulations, such as capital requirements rules or other policy measures which cap a bank's fossil fuel assets, enables a managed, gradual decline in fossil fuel lending. On the one hand, overly stringent requirements could precipitate a tipping point too early, leading to a disruptive transition in which the failure of fossil fuel companies is too widespread to be managed sustainably. Conversely, loose requirements resulting in a late, or non-existent, tipping point could delay the emission reductions necessary to keep Paris temperature targets within reach. Such rules can be developed by formal standard-setting bodies and prudential regulators, such as the Basel Committee on Banking Supervision and the Financial Stability Board. Additionally, voluntary alliances, such as the Net Zero Banking Alliance (NZBA, 2021), can amplify the effect of these regulatory measures through coordinated climate transition strategies among member banks, reinforcing the impact of regulatory interventions.

This framework of macroprudential regulation integrates two fundamental mechanisms within the financial system: market-driven adjustments to risk and return profiles and alignment strategies that purposefully steer capital flows in line with climate objectives. Policies such as carbon-adjusted capital requirements and high-carbon asset divestment mandates exemplify this approach, systematically shifting capital away from high-carbon sectors and fostering a low-carbon economy. Carbon-adjusted capital requirements, for instance, elevate the perceived risk of high-carbon assets, encouraging the reallocation of capital toward lower-risk, low-carbon alternatives and reshaping sector-wide capital costs. Similarly, divestment mandates reduce the financial liquidity available to fossil fuel firms, increasing their borrowing costs and eroding their long-term competitiveness.

This proactive regulatory strategy transcends incremental adjustments in lending rates, effecting fundamental shifts in financial risk assessment and capital allocation models. By embedding low-carbon preferences within regulatory frameworks, these policies catalyse a transformative cycle in investment patterns, promoting a financial environment in which low-carbon investments are seen as both stable and strategically advantageous. Early regulatory intervention thus facilitates a systemic realignment of capital markets, fostering reduced reliance on carbon-intensive infrastructure and accelerating the decarbonization of the real economy. Of course, such a swing in the real economy cannot happen only through the activation of tipping points in the financial system. Coordination between financial and non-financial policy is key. Indeed, the utilization of policy mixes that incorporate a combination of command-and-control and market-based instruments can be likened to “kicks” that yield positive outcomes for the transition to a net-zero carbon economy (see Wieners et al., 2024). These could take the form of policy mandates such as progressive emission reduction targets, environmental and industrial regulation, mandated transition planning, green central banking, and green building codes, coupled with market-shifting initiatives like carbon pricing, climate-related financial disclosures, green subsidies, risk-underwriting mechanisms, and green certificates. Recent advancements in modelling have demonstrated that these policy combinations have the potential to initiate a virtuous cycle, driving technological development and reducing public investment needs while fostering employment and economic growth (Wieners et al., 2024; Lamperti et al., 2020; Lamperti and Roventini, 2022; Stern and Stiglitz, 2023). These positive feedback loops also significantly lessen the reliance on carbon taxes by decreasing their intensity. As a result, this enhances their political acceptability and potentially triggers another tipping point.

The success of these policy-driven tipping points will ultimately depend on their broad impact across the financial system and the real economy. Policies that only reach narrow segments of the financial market, such as commercial banks or publicly listed companies, or only impact flows from a specific country or geography (such as EU-wide) may lead to asset shifts rather than an overall reduction in high-carbon investments. Broad-based, well-coordinated policies are thus needed to drive markets past a tipping point where financial markets are unable to adequately substitute the money, leaving high-carbon assets. Therefore, a comprehensive approach that addresses diverse financial channels is crucial. Furthermore, different financial policies are likely to draw a diverse response from market participants, such as the impact of capital reserve requirements for the banking sector or carbon disclosure requirements for asset managers that might not have a significant impact on other actors like private equity funds. Similarly, sector-specific incentives, such as mandates for green sector investments or market-based incentives that influence the risk-adjusted returns of these projects, ensure that redirected capital flows support true decarbonization.

Equally important is cultivating demand for green finance within the real economy. Without a corresponding demand from firms and industries for sustainable capital, there is a risk of oversupply, potentially creating inflated valuations in green assets – a phenomenon sometimes described as a “green bubble”. Thus, real-sector policies are essential to foster demand and support for decarbonization efforts. Policies such as carbon pricing, clean energy subsidies, and sector-specific decarbonization mandates generate substantive incentives for businesses to seek sustainable finance, anchoring green investments in real economic needs. For instance, carbon pricing mechanisms directly increase the cost of emission-intensive activities, prompting firms to pursue lower-carbon alternatives and thus creating a demand for financing aligned with decarbonization goals. Similarly, subsidies for renewable energy or efficiency upgrades enhance the economic viability of sustainable projects, making them attractive to private capital.

This alignment between real-sector policies and financial initiatives mitigates the risk of capital misallocation and speculative investment in unsustainable assets. By ensuring that sustainable finance is underpinned by genuine demand from the real economy through concrete decarbonization goals and strategies, such policy coordination fosters a stable growth environment for sustainable finance. This integrated approach helps prevent speculative distortions, supporting resilient and effective financial flows that drive real-economy decarbonization and reduce reliance on regulatory interventions alone. Ultimately, the alignment of financial and real-sector policies creates a reinforcing cycle: financial flows support real-sector decarbonization, and real-economy demand strengthens the viability of sustainable finance. This synergy promotes a balanced, sustainable expansion of low-carbon investments, minimizing the risks of volatility and speculative bubbles and ensuring a more stable pathway towards a decarbonized economy.

Finally, the interlinkage between financial and other economic systems needs to be acknowledged. Policy mixes work well because they influence multiple systems and attempt to gain non-linear benefits through reinforcing mechanisms and positive tipping points.

As of today, the financial sector is contributing to a projected +3 °C global warming scenario by 2100. The financial system itself does not inherently favour any particular climate objectives ex ante. To successfully shift the economy towards a net-zero emission path, it becomes crucial to harness the potential of tipping points in the financial system in order to contribute to this transition in its full capacity, by enabling and accelerating the necessary capital reallocation. These elements can play a pivotal role in redirecting economic activities towards sustainable practices.

Taken together, the mechanisms detailed above highlight examples of the system-wide tipping points' potential within sustainable finance and emphasize the necessity of policy interventions to activate and capitalize on these dynamics. Through the alignment of expectations, promotion of herding behaviour, utilization of public finance, reduction in capital costs, attainment of low-carbon investment thresholds in developing economies, and implementation of robust financial regulation and policies, the financial system can assume a central role in expediting the shift towards a net-zero carbon economy.

Regulation plays a critical role in driving tipping points within the financial sector, and its role has become increasingly prominent in recent years. A climate risk information ecosystem has evolved with standards for climate-related financial data, assessing climate risk impacts, transparency requirements, green taxonomies, green labels for financial products, and transition risk management plans (International Monetary Fund, 2023). Robust monitoring and supervision by entities like central banks and financial regulators are forcing financial institutions to move faster and more decisively than market signals alone would prompt them to do. In this regard, policy makers and financial authorities hold the potential to take a leading role in steering the financial system towards transformative tipping points, dedicated to financing the transition to a net-zero carbon economy. A just transition needs investments in all parts of the economy and society. This will in turn require policy combinations incorporating both market-based and structural change instruments to work effectively to deliver opportunities and investment-friendly conditions while avoiding trade-offs between prudential behaviour and a shift in asset allocation by financial institutions to low-carbon activities. As key stakeholders increase their efforts to guide the financial system, leveraging all the available tools and exploring new avenues, they can also create a coordinated momentum with industrial policy makers. In this way, financial and economic policies can be more effectively aligned to support sustainable industries and practices. This collaboration further builds momentum and strengthens the potential for the activation of tipping points in the financial system, where the identification of critical intervention points can lead to the amplification of sustainable investments, mitigate risks, and foster transformative changes in the practices of the financial sector.

No data sets were used in this article.

NA, FL, and HC conceptualized and designed the article's structure. All authors contributed to the drafting, writing, and critical revision of the paper. NA and FL coordinated and supervised the finalization of the article.

Publisher’s note: Copernicus Publications remains neutral with regard to jurisdictional claims made in the text, published maps, institutional affiliations, or any other geographical representation in this paper. While Copernicus Publications makes every effort to include appropriate place names, the final responsibility lies with the authors.

This article is part of the special issue “Tipping points in the Anthropocene”. It is a result of the “Tipping Points: From Climate Crisis to Positive Transformation” international conference hosted by the Global Systems Institute (GSI) and University of Exeter (12–14 September 2022), as well as the associated creation of a Tipping Points Research Alliance by GSI and the Potsdam Institute for Climate Research, Exeter, Great Britain, 12–14 September 2022.

Nadia Ameli, Jamie Rickman, Sumit Kothari received support from the European Research Council (ERC) under the European Union’s Horizon 2020 research and innovation programme (grant no. 802891). Max Falkenberg received support from the European Union’s Horizon Europe research and innovation programme under the Marie Skłodowska-Curie Actions (grant no. 101148808). Francesco Lamperti received financial support from the United Kingdom Department for Business, Energy and Industrial Strategy (project EEIST), the Italian Ministry of Research (project NEWS 2022PNR PRIN), and the European Union (ERC, project FIND, 101117427).

This paper was edited by Caroline Zimm and reviewed by Charlotte Gardes and two anonymous referees.

Ameli, N., Drummond, P., Bisaro, A., Grubb, M., and Chenet, H.: Climate finance and disclosure for institutional investors: why transparency is not enough, Climatic Change, 160, 565–589, https://doi.org/10.1007/s10584-019-02542-2, 2020.

Ameli, N., Dessens, O., Winning, M., Cronin, J., Chenet, H., Drummond, P., Calzadilla, A., Anandarajah, G., and Grubb, M.: Higher cost of finance exacerbates a climate investment trap in developing economies, Nat. Commun., 12, 4046, https://doi.org/10.1038/s41467-021-24305-3, 2021a.

Ameli, N., Kothari, S., and Grubb, M.: Misplaced expectations from climate disclosure initiatives, Nat. Clim. Change, 11, 917–924, https://doi.org/10.1038/s41558-021-01174-8, 2021b.

Ameli, N., Chenet, H., Falkenberg, M., Kothari, S., Rickman, J., and Lamperti, F.: Driving sustainability transitions through financial tipping points, EGUsphere [preprint], https://doi.org/10.5194/egusphere-2023-1750, 2023b.

Ansar, A., Caldecott, B., and Tilbury, J.: Stranded assets and the fossil fuel divestment campaign: what does divestment mean for the valuation of fossil fuel assets? Stranded Assets Programme Report, https://www.smithschool.ox.ac.uk/sites/default/files/2022-03/SAP-divestment-report-final.pdf (last access: June 2022), 2013.

Arthur, W. B.: Competing technologies, increasing returns, and lock-in by historical events, Econ. J., 99, 116–131, 1989.

Bernanke, B., Gertler, S. M., and Gilchrist, S.: The financial accelerator in a quantitative business cycle framework, Handbook of Macroeconomics, 1, 1341–1393, https://doi.org/10.1016/S1574-0048(99)10034-X, 1999.

Bikhchandani, S. and Sharma, S.: Herd behavior in financial markets, IMF Staff Papers, 47, 279–310, https://www.imf.org/external/pubs/ft/staffp/2001/01/pdf/bikhchan.pdf (last access: June 2022), 2000.

Bilir, L. K., Chor, D., and Manova, K.: Host-country financial development and multinational activity, Eur. Econ. Rev., 115, 192–220, https://doi.org/10.1016/j.euroecorev.2019.02.008, 2019.

Broeders, D. and Jansen, K.: Pension funds' portfolio choices and investment beliefs. Policy brief, https://www.suerf.org/publications/suerf-policy-notes-and-briefs/pension-funds-portfolio-choices-and-investment-beliefs/ (last access: June 2022), 2021.

Campiglio, E. and Lamperti, F.: Sustainable Finance Policy-Making: Why and How, European Economy, 59–74, https://european-economy.eu/2021-2/sustainable-finance-policy-making-why-and-how/ (last access: June 2022), 2021.

Campiglio, E., Lamperti, F., and Terranova, R.: Believe me when I say green! Heterogeneous expectations and climate policy uncertainty, J. Econ. Dyn. Control, 165, 104900, https://doi.org/10.1016/j.jedc.2024.104900, 2024.

Carney, M.: Breaking the Tragedy of the Horizon – climate change and financial stability, Speech by Mr Mark Carney, Gov. Bank Engl. Chairm. Financ. Stab. Board, Lloyd's London, London, https://www.bis.org/review/r151009a.pdf (last access: June 2022), 2015.

Chenet, H.: Climate change and biodiversity loss: new territories for financial authorities, Curr. Opin. Env. Sust., 68, 101449, https://doi.org/10.1016/j.cosust.2024.101449, 2024a.

Chenet, H.: Financial institutions in the face of environmental emergency. The Elgar Companion to Energy and the Sustainable Development Goals, Edward Elgar Publishing, https://doi.org/10.4337/9781035307494.00032, 2024b.

Chenet, H., Ryan-Collins, J., and Van Lerven, F.: Finance, climate-change and radical uncertainty: Towards a precautionary approach to financial policy, Ecol. Econ., 183, 106957, https://doi.org/10.1016/j.ecolecon.2021.106957, 2021.

Christophers, B.: Fossilised Capital: Price and Profit in the Energy Transition, New Polit. Econ., 27, 146–159, https://doi.org/10.1080/13563467.2021.1926957, 2022.

Dosi, G. and Roventini, A.: More is different... and complex! the case for agent-based macroeconomics, J. Evol. Econ., 29, 1–37, https://doi.org/10.1007/s00191-019-00609-y, 2019.

Dosi, G., Lamperti, F., Mazzucato, M., Napoletano, M., and Roventini, A.: Mission-oriented policies and the “Entrepreneurial State” at work: An agent-based exploration, J. Econ. Dyn. Control, 151, 104650, https://doi.org/10.1016/j.jedc.2023.104650, 2023.

Egli, F., Steffen, B., and Schmidt, T. S.: A dynamic analysis of financing conditions for renewable energy technologies, Nature Energy, 3, 1084–1092, https://doi.org/10.1038/s41560-018-0277-y, 2018.

Gatti, D., Gallegati, M., Greenwald, B., Russo, A., and Stiglitz, J. E.: The financial accelerator in an evolving credit network, J. Econ. Dyn. Control, 34, 1627–1650, https://doi.org/10.1016/j.jedc.2010.06.019, 2010.

Farmer, J. D. and Foley, D.: The economy needs agent-based modelling, Nature, 460, 685–686, https://doi.org/10.1038/460685a, 2009.

Farmer, J. D., Hepburn, C., Ives, M. C., Hale, T., Wetzer, T., Mealy, P., Rafaty, R., Srivastav S., and Way, R.: Sensitive intervention points in the post-carbon transition, Science, 364, 132–134, https://doi.org/10.1126/science.aaw7287, 2019.

FTM: The Great Green Investment Investigation: Fossil Finance, https://www.ftm.eu/fossil-finance (last access: June 2022), 2023.

Gallagher, K., Rustomjee, C., and Arevalo, A.: Evolution of IMF Engagement on Climate Change, IEO Background Paper No. BP/24-01/06, 2024.

International Monetary Fund: Global Financial Stability Report: Financial and Climate Policies for a High-Interest-Rate Era, https://www.imf.org/en/Publications/GFSR/Issues/2023/10/10/global-financial-stability-report-october-2023 (last access: June 2022), 2023.

Kedward, K., Zu Ermgassen, S., Ryan-Collins, J., and Wunder, S.: Heavy reliance on private finance alone will not deliver conservation goals, Nature Ecology & Evolution 7, 1339–1342, https://doi.org/10.1038/s41559-023-02098-6, 2023a.

Kedward, K., Ryan-Collins, J., and Chenet, H.: Biodiversity loss and climate change interactions: financial stability implications for central banks and financial supervisors, Clim. Policy, 23, 763–781, https://doi.org/10.1080/14693062.2022.2107475, 2023b.

Kirsch, A., Opena Disterhoft, J., Marr, G., McCully, P., Breech, R., Dilworth, T., and Wickham, M. S.: Banking on Climate Chaos, https://www.bankingonclimatechaos.org/bankingonclimatechaos2021/ (last access: June 2022), 2021.

Kothari, S., Strachan, N., and Ameli, N.: Heterogeneous actors and relationships in the global solar finance market, in progress, 2025.

Kreibiehl, S., Jung, T. Y., Battiston, S., Carvajal, P. E., Clapp, C., Dasgupta, D., Dube, N., Jachnik, R., Morita, K., Samargandi, N., and Williams, M.: Investment and finance, in: IPCC, 2022: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, edited by: Shukla, P. R., Skea, J., Slade, R., Al Khourdajie, A., van Diemen, R., McCollum, D., Pathak, M., Some, S., Vyas, P., Fradera, R., Belkacemi, M., Hasija, A., Lisboa, G., Luz, S., and Malley, J., Cambridge University Press, Cambridge, UK and New York, NY, USA, https://doi.org/10.1017/9781009157926.017, 2022.

Lamperti, F. and Roventini, A.: Beyond climate economics orthodoxy: impacts and policies in the agent-based integrated-assessment DSK model, European Journal of Economics and Economic Policies: Intervention, 19, 357–380, https://doi.org/10.4337/ejeep.2022.0096, 2022.

Lamperti, F., Dosi, G., Napoletano, M., Roventini, A., and Sapio, A.: Climate change and green transitions in an agent-based integrated assessment model, Technol. Forecast. Soc., 153, 119806, https://doi.org/10.1016/j.techfore.2019.119806, 2020.

Lamperti, F., Bosetti, V., Roventini, A., Tavoni, M., and Treibich, T.: Three green financial policies to address climate risks, J. Financ. Stabil., 54, 100875, https://doi.org/10.1016/j.jfs.2021.100875, 2021.

Lenton, T. M., Benson, S., Smith, T., Ewer, T., Lanel, V., Petykowski, E., Powell, T. W. R., Abrams, J. F., Blomsma, F., and Sharpe, S.: Operationalising positive tipping points towards global sustainability, Glob. Sustain. 5, e1, https://doi.org/10.1017/sus.2021.30, 2022.

Mazzucato, M.: Entrepreneurial State: Debunking Public Vs. Private Sector Myths, Anthem Press, https://doi.org/10.4337/roke.2015.01.10, 2013.

Mazzucato, M. and Semieniuk, G.: Financing renewable energy: Who is financing what and why it matters, Technol. Forecast. Soc., 127, 8–22, https://doi.org/10.1016/j.techfore.2017.05.021, 2018.

NZBA: Homepage, https://www.unepfi.org/net-zero-banking/ (last access: June 2022), 2021.

Perez, C.: Technological revolutions and financial capital, Edward Elgar Publishing, https://www.elgaronline.com/edcollchap/9781843760443.00010.xml (last access: June 2023), 2003.

Richardson, K., Steffen, W., Lucht, W., Bendtsen, J., Cornell, S.E., Donges, J.F., Drüke, M., Fetzer, I., Bala, G., von Bloh, W., Feulner, G., Fiedler, S., Gerten, D., Gleeson, T., Hofmann, M., Huiskamp, W., Kummu, M., Mohan, C., Nogués-Bravo, D., Petri, S., Porkka, M., Rahmstorf, S., Schaphoff, S., Thonicke, K., Tobian, A., Virkki, V., Wang-Erlandsson, L., Weber, L., and Rockström, J.: Earth beyond six of nine planetary boundaries, Science Advances, 9, eadh2458, https://doi.org/10.1126/sciadv.adh2458, 2023.

Rickman, J., Kothari, S., Larosa, F., and Ameli, N.: Investment suitability and path dependency perpetuate inequity in international mitigation finance towards developing countries, One Earth, 6, 1304–1314, https://doi.org/10.1016/j.oneear.2023.09.006, 2023.

Rickman, J., Falkenberg, M., Kothari, S., Larosa, F., Grubb, M., and Ameli, N.: The challenge of phasing out fossil fuel finance in the banking sector, Nat. Commun., 15, 7881, https://doi.org/10.1038/s41467-024-51662-6, 2024.

Rockström, J., Steffen, W., Noone, K., Persson, Å., Chapin III, F. S., Lambin, E. F., Lenton, T. M., Scheffer, M., Folke, C., Schellnhuber, H. J., Nykvist, B., de Wit, C. A., Hughes, T., van der Leeuw, S., Rodhe, H., Sörlin, S., Snyder, P. K., Costanza, R., Svedin, U., Falkenmark, M., Karlberg, L., Corell, R. W., Fabry, V. J., Hansen, J., Walker, B., Liverman, D., Richardson, K., Crutzen, P., and Foley, J. A.: A safe operating space for humanity, Nature, 461, 472–475, 2009.

Ruzzenenti, F., Hubacek, K., and Gabbi, G.: In the fight against climate change, did the financial sector cut secular ties with the oil industry or merely camouflage them?, Cleaner Production Letters, 4, 100040, https://doi.org/10.1016/j.clpl.2023.100040, 2023.

Sastry, P., Verner, E., and Marques-Ibanez, D.: Business as Usual: Bank Climate Commitments, Lending, and Engagement, ECB Working Paper No. 2024/2921, https://doi.org/10.2139/ssrn.4772562, 2024.

Schwerhoff, G. and Sy, M.: Financing renewable energy in Africa – Key challenge of the sustainable development goals, Renewable and Sustainable Energy Reviews, 75, 393–401, https://doi.org/10.1016/j.rser.2016.11.004, 2017.

Sharpe, S. and Lenton, T. M.: Upward-scaling tipping cascades to meet climate goals: plausible grounds for hope, Clim. Policy, 21, 421–433, https://doi.org/10.1080/14693062.2020.1870097, 2021.

Stern, N. and Stiglitz, J. E.: Climate change and growth, Ind. Corp. Change, 32, 277–303, https://doi.org/10.1093/icc/dtad008, 2023.

Svartzman, R., Espagne, E., Gauthey, J., Hadji-Lazaro, P., Salin, M., Allen, T., Berger, J., Calas, J., Godin, A., and Vallier, A.: A “Silent Spring” for the Financial System? Exploring Biodiversity-Related Financial Risks in France, 826, Paris, https://publications.banque-france.fr/sites/default/files/medias/documents/wp826_0.pdf (last access: June 2023), 2021.

Tàbara, J. D., Frantzeskaki, N., Hölscher, K., Pedde, S., Kok, K., Lamperti, F., Christensen, J. H., Jäger, J., and Berry, P.: Positive tipping points in a rapidly warming world, Curr. Opin. Environ. Sustain. 31, 120–129, https://doi.org/10.1016/j.cosust.2018.01.012, 2018.

Tong, D., Zhang, Q., Zheng, Y., Caldeira, K., Shearer, C., Hong, C., Qin Y., and Davis, S. J.: Committed emissions from existing energy infrastructure jeopardize 1.5 °C climate target, Nature, 572, 373–377, https://doi.org/10.1038/s41586-019-1364-3, 2019.

UNCTAD: World Investment Report, Chap. 3, Sustainable finance trends, eISBN 978-92-1-358973-1, https://unctad.org/system/files/official-document/wir2024_en.pdf (last access: June 2022), 2024.

Way, R., Lafond, F., Lillo, F., Panchenko, V., and Farmer, J.D.: Wright meets Markowitz: How standard portfolio theory changes when assets are technologies following experience curves, J. Econ. Dyn. Control, 101, 211–238, https://doi.org/10.1016/j.jedc.2018.10.006, 2019.

Wieners, C., Lamperti, F., Dosi, G., and Roventini, A.: Macroeconomic policies for rapid decarbonization, steady economic transition and employment creation, https://assets-eu.researchsquare.com/files/rs-4637209/v1_covered_de7b568c-7193-4113-9764-98cdb191661e.pdf (last access: June 2022), 2024.

World Bank: Finance and Prosperity Report. Acting on Climate Risks and Climate Finance through the banking sector, Chap. 3, World Bank publishing, https://openknowledge.worldbank.org/server/api/core/bitstreams/37f48198-44db-4e92-9da8-5a3dea1ccdef/content (last access: June 2022), 2024.

Zamarioli, L. H., Pauw, P., König, M., and Chenet, H.: The climate consistency goal and the transformation of global finance, Nat. Clim. Change 11, 578–583, https://doi.org/10.1038/s41558-021-01083-w, 2021.

See e.g. Questions and Answers on the Sustainable Finance package (https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_3194, last access: June 2023) and Strategy for Financing the Transition to a Sustainable Economy (https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52021DC0390, last access: June 2022)

CSRD and ISSB approaches are essentially distinguished by their respective materiality frameworks: ISSB is based on single “financial materiality”, while CSRD relies on both financial and “socio-environmental impact materiality”, i.e. “double materiality”.

Trade-offs between climate- and biodiversity-related actions are, for example, on car electrification (a priori good for climate if based on renewable power but potentially bad for biodiversity if batteries rely on new extensive mining) or bioenergy (a priori good for climate if substituting fossil fuels but potentially bad for biodiversity if crops rely on extensive land use change).

See e.g. BNP Paribas Annual Report 2005: https://invest.bnpparibas/en/document/annual-report-2005 (last access: June 2022) (pp. 68–72, 107–113, 330–344)

NB: the efficiency of these initiatives is nevertheless questioned, from the business-as-usual financing decisions (Sastry et al., 2024) to the current “ESG backlash” in the US (e.g. “The real impact of the ESG backlash”, FT 2024, https://www.ft.com/content/a76c7feb-7fa5-43d6-8e20-b4e4967991e7 (last access: January 2024); “Insurance industry turmoil over climate alliance exodus”, FT 2023, https://www.ft.com/content/1dd66ce1-a720-4c56-96d9-8d47f07f376f).

Macroprudential policy is composed of different tools having the goal of preserving financial stability. This includes making the financial system more resilient to losses and limiting the build-up of vulnerabilities in order to mitigate systemic risk and ensure that financial services continue to be provided effectively to the economy.